Contents:

Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived. Unlike other platforms, which support trading with a broad spectrum of securities, crypto and other asset types, Lightspeed supports only stocks, options and futures trading. Traders use charting and other analysis tools to make informed decisions on whether to buy or sell stocks, ETFs, options, currencies, crypto and other types of investment vehicles. One of the main advantages of technical analysis is that it is considered as a neutral trading tool. You can apply it to virtually any instrument over any timeframe, and it doesn’t rely on an analyst’s forecast.

Intra-day traders, traders who open and close trading positions within a single trading day, favor analyzing price movement on shorter time frame charts, such as the 5-minute or 15-minute charts. Long-term traders who hold market positions overnight and for long periods of time are more inclined to analyze markets using hourly, 4-hour, daily, or even weekly charts. Advanced analytics is an umbrella term referring to a range of data analysis techniques used primarily for predictive purposes, such as machine learning, predictive modeling, neural networks, and AI. Businesses employ advanced analytics primarily to forecast future outcomes and to guide their decision-making, not just to gain business insights. The second half of the book targets more advanced and experienced traders who want to improve their trading skills. The detailed account of more than 135 technical indicators is also worth mentioning.

Latest Oil Market News and Analysis for April 17 – Bloomberg

Latest Oil Market News and Analysis for April 17.

Posted: Sun, 16 Apr 2023 22:56:23 GMT [source]

Overall, this book is complex and not easily understandable even for traders. However, it is a top read for those who wish to learn stock market behaviors. Moreover, the extensive experience of the author as a successful trader and trainer of traders is noteworthy.

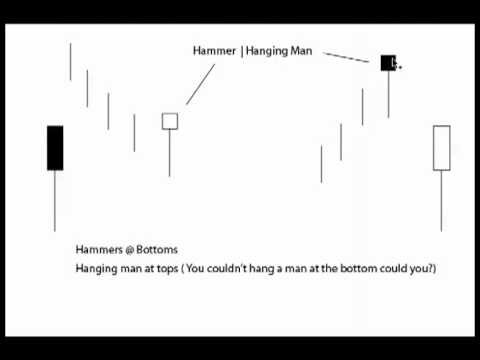

Candlestick Patterns – Dojis

Bollinger Bands combine the concept of a moving average with standard deviations around the moving average. This tool is useful in defining a trading range for the security being analyzed. The idea is that periods of low volatility are followed by periods of high volatility, so that relatively narrow band width can foreshadow an advance or decline in the security under analysis. Technical indicators are used to derive additional information from basic chart patterns.

Technical analysis is based on the premise that the market reflects all available information, and therefore, price movements are driven by supply and demand. Technical analysis techniques like moving averages, oscillators, and indicators are used to identify trends, momentum, and market sentiment. Bollinger Bands, developed by and named for noted technical analyst John Bollinger, employ a concept frequently used in the technical analysis of securities – standard deviation. Standard deviation is, essentially, a measure of how far the price of a security diverges from its mean average. Bollinger bands provide a sort of range trendline where the range expands or contracts in conjunction with increased or decreased volatility. They do this by measuring how far closing prices are away from a 20-period moving average.

USD/JPY Technical Analysis: Compensate for Losses – DailyForex.com

USD/JPY Technical Analysis: Compensate for Losses.

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

As we’ve seen, technical analysis looks at price movements and uses this data to try and predict future price movements. Fundamental analysis, on the other hand, attempts to measure the intrinsic value of a security. It also looks at the financial conditions and management of companies through company analysis. Things like earnings, expenses, assets and liabilities are important to fundamental analysts.

Best Day Trading Books Of All Time

The bullish engulfing pattern occurs when a market has been in a downtrend. Bullish engulfing patterns usually consist of two complete candlesticks spanning two time periods . The first is a ‘down’ or bearish candlestick, followed by an ‘up’ or bullish candlestick covering the subsequent time period. Being able to identify trends is one of the most important concepts of technical analysis.

Interactive Brokers also offers margin trading, its research and charting tools have a solid reputation, and its commissions are reasonable overall. TradingView offers a free trial plus subscriptions ranging from $15 to $60 per month with a range of additional features and data. There is no single ‘magic’ approach to the forex market that will always yield positive results. The secret of successful trading is good risk management, discipline, and the ability to control your emotions.

- The company says that everyone gets smart tools for smart investing and allows trading access to stocks including fractional shares, options, ETFs OTC securities and crypto.

- This is bullish divergence – and can be a suggestion that the downtrend is running out of steam, which proved to be the case in this example.

- In this bottom-up approach, analysts are looking for undervalued stocks and securities or ones that are going against market trends.

- As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested.

- His book has it to teach you ins and outs of technical analysis through precise and relevant information.

In a 2000 paper, Andrew Lo back-analyzed data from the U.S. from 1962 to 1996 and found that «several technical indicators do provide incremental information and may have some practical value». Burton Malkiel dismissed the irregularities mentioned by Lo and McKinlay as being too small to profit from. Lightspeed Trader is a downloadable trading app that features a selection of technical indicators, drawing tools and different chart types traders can use to analyze potential trades.

Best Stock Trading Books for Beginners & Advanced Traders

In this article, the author analyses Fibonacci retracement patterns in an uptrend and downtrend. Understand how to plot Fibonacci Arcs, Fans, Channels and Expansions to identify support and resistance levels. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets (e.g. the stock market).

Philips joins forces with AWS to bring Philips HealthSuite Imaging … – usa.philips.com

Philips joins forces with AWS to bring Philips HealthSuite Imaging ….

Posted: Mon, 17 Apr 2023 12:00:00 GMT [source]

The basis of advance technical analysis analysis comes partly from Chaos Theory – the hypothesis that identifiable patterns will repeat in even the most chaotic-seeming areas. Instead of making concrete assertions about market behavior, technical traders use these patterns to determine the probability of a certain move. In addition to studying candlestick formations, technical traders can draw from a virtually endless supply of technical indicators to assist them in making trading decisions. At its core, advanced analytics is really just a collection of data analytics techniques and methodologies. While some of these techniques are well-understood by entry-level data analysts, others are more often used by data scientists, data engineers, and machine learning engineers.

Many https://trading-market.org/ indicators have been produced, and traders continue developing new types to improve performance. For example, back-testing new technical indicators using historical price and volume data is common to evaluate how effective they would have been in predicting future events. The Gartley pattern is frequently used in conjunction with other chart patterns or technical indicators by technical analysts. Market prediction is difficult, but charts come in handy when predicting market direction. By ‘advanced,’ we mean using multi-technical indicators or methods that specialize in predicting market movement.

Is Your Risk/Reward Enough?

Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. If the market really walks randomly, there will be no difference between these two kinds of traders. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. In the late 1980s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis.

It refers to using multi-technical indicators or methods that specialize in predicting market movement. Trend changes can often be spotted using the Heiken Ashi when a candlestick of the opposite color appears with a long shadow in the opposite direction of the previously existing trend. It can be seen in the uptrend and downtrend, which appear on the left-hand side of the chart.

Common indicators used in technical analysis include Bollinger Bands and Fibonacci retracements. Lots of traders use candlestick charts when looking at price action data and it is easy to see why. Candlesticks present the battle between buyers and sellers in a very simple-to-interpret graphical way. Candlestick charts also have their own range of patterns, with many focusing on the psychology of the market and constant battle between buyers and sellers.

The potential advantage for traders is being able to ride a trend longer rather than being “faked out” by one or two candles that would appear pointing in the opposite direction on a regular candlestick chart. Traders are advised against initiating a trade while the current price level is located within the cloud. When the price is within the cloud, the market is considered to be trendless or ranging. Wait for a clear breakout from the cloud, either to the upside or the downside. The strength or momentum of a trend are indicated by how steep the slopes of the tenkan and kijun lines are, and by how far away from price action, above or below it, that the chinkou span line is.

Many of the patterns follow as mathematically logical consequences of these assumptions. The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. Several trading strategies rely on human interpretation, and are unsuitable for computer processing. Only technical indicators which are entirely algorithmic can be programmed for computerized automated backtesting. Modern technical analysis software is often available as a web or a smartphone application, without the need to download and install a software package. Some of them even offer an integrated programming language and automatic backtesting tools.

Indicators are placed over chart data to try and predict the price direction and market trend. Technical analysis is the very foundation of stock trading, with any trader needing to be able to understand the trends of price and stock movements to truly understand their next move and make the smartest decisions possible. InTechnical Analysis from A to Z, 2nd Edition, you get an updated look at trading through a modern-day lens with a detailed explanation of just what technical analysis is as well as exactly how to use it.

Stocks in a channel

With their extensive knowledge and expertise, SS Trading Academy is the perfect place to start your journey towards becoming a successful trader. For example, the RSI is often used to identify overbought and oversold conditions. If an asset’s RSI reaches a level above 70, this can indicate that the asset is overbought and may be due for a price correction. Choose the max of the current period’s high or the current period’s HA open or close to adding the next high. The Structured Query Language comprises several different data types that allow it to store different types of information… The tenkan sen crossing from below to above the kijun sen line is a buy signal.

The result is that during an uptrend, Heiken Ashi candles will appear as a more unbroken succession of up candles – and in a downtrend, as more consistently down candles. Bollinger found that by plotting the bands at two standard deviations, both above and below the moving average, roughly 90% of all closing prices should fall within the range of the bands. For all its features, one area where the Ichimoku system is weak is that of profit targets. Other than being stopped out of a trade, the Ichimoku does not offer much guidance in the area of picking profit targets, good potential trade exit points. The fact is that the Ichimoku is more concerned with minimizing risk than it is with maximizing profits. However, if you’re looking for a potential “take profits” level, don’t forget that the chinkou span line may reveal the peak or bottom of a trend some time in advance of the market actually reaching that price level.

The company says that everyone gets smart tools for smart investing and allows trading access to stocks including fractional shares, options, ETFs OTC securities and crypto. Well done, you’ve completed Understanding technical analysis, lesson 1 in Technical analysis. Or, even better, you might be able to use technical analysis to spot when overall sentiment on a market is reversing. You just plug a Fibonacci indicator into your charting software and it displays all the various Fibonacci levels.

Technical analysis can use either a top-down approach or a bottom-up approach to analyze securities. The top-down method is useful for identifying outperforming asset classes, countries, or sectors. Allocation shifts can occur within an asset class or across asset classes. The bottom-up method is useful for identifying individual stocks, commodities, or currencies that are outperforming, irrespective of market, industry, or macro trends. Attend this in-depth two-day course and gain a comprehensive understanding of advanced technical tools and trading strategies, and how and when they should be used. Let’s take a look at some of the basics of technical analysis so we can get a better understanding of what elements are used to analyze stocks and other securities.