In this case, the optimal solution is the point where the red and blue lines intersect, as you’ll see later. The basic method for solving linear programming problems is called the simplex method, which has several variants. Often, when people try to formulate and solve an optimization problem, the first question is whether they can apply linear programming or mixed-integer linear programming.

Nonetheless, if you buy 4 razor blades, you will need to buy razor blades again in 4 days (assuming that you shave daily) and you will spend more money on gas, which is not smart. So what we usually do is mentally solving an optimization problem. Linear programming is a powerful tool for helping organisations make informed decisions quickly.

Using PuLP

Scheduling problems involve assigning resources to perform a set of tasks at

specific times. An important example is the job shop problem, in which

multiple jobs are processed on several machines. Each job consists of a sequence of tasks, which must be performed in a given

order, and each task must be processed on a specific machine. The problem is to

assign a schedule so that all jobs are completed in as short an interval of time

as possible. We need to choose a student for each of the four swimming styles such that

the total relay time is minimized.

One of them is PuLP, which you’ll see in action in the next section. Opt.status is 0 and opt.success is True, indicating that the optimization problem was successfully solved with the optimal feasible solution. PuLP allows you to choose solvers and formulate problems in a more natural way. The default solver used by PuLP is the COIN-OR Branch and Cut Solver (CBC). It’s connected to the COIN-OR Linear Programming Solver (CLP) for linear relaxations and the COIN-OR Cut Generator Library (CGL) for cuts generation.

If session_assigned is equal to 1 then the rule must be held. However, if session_assigned is 0 then (assuming M is large enough) the second term on the RHS becomes much larger than the first so the entire RHS is always negative. Since our variable bounds force case_start_time ≥ 0, there is effectively no additional restriction. Methods hybr and lm in root cannot deal with a very large

number of variables (N), as they need to calculate and invert a dense N

x N Jacobian matrix on every Newton step. Often only the minimum of an univariate function (i.e., a function that

takes a scalar as input) is needed. In these circumstances, other

optimization techniques have been developed that can work faster.

This algorithm is guaranteed to give an accurate solution

eventually, but may require up to n iterations for a problem with n

variables. Additionally, an ad-hoc initialization procedure is

implemented, that determines which variables to set free or active

initially. It takes some number of iterations before actual BVLS starts,

but can significantly reduce the number of further iterations. Assignment problems involve assigning a group of agents (say, workers or

machines) to a set of tasks, where there is a fixed cost for assigning each

agent to a specific task. The problem is to find the assignment with the least

total cost.

- The coefficients of the linear objective function to be minimized.

- See functions such as Task.putarow, Task.putarowlist, Task.putaijlist, Task.putacol and similar.

- As you are an alien, the solution of your problem will be to spend 0 money and buy 0 razor blades.

- After some time studying python, I thought it would be fun to rework one of my linear optimization projects I originally did in Excel’s solver.

- Formulate a mathematical model of Giapetto’s situation that can be used to maximize Giapetto’s weekly profit.

If a single tuple (min, max) is provided, then min and max

will serve as bounds for all decision variables. For instance, the

default bound (0, None) means that all decision variables are

non-negative, and the pair (None, None) means no bounds at all,

i.e. all variables are allowed to be any real. As you can see, the optimal solution is the rightmost green point on the gray background. This is the feasible solution with the largest values of both x and y, giving it the maximal objective function value. The objective function (profit) is defined in condition 1.

Luckily, we can use one of the many packages designed for precisely this purpose, such as pulp, PyGLPK, or PyMathProg. I’d recommend the package cvxopt for solving convex optimization problems in Python. A short example with Python code for a linear program is in cvxopt’s documentation here. Let’s say you are buying groceries, and you need to buy razor blades. Of course, if you buy razor blades you won’t have any money left in your bank.

Linear least-squares#

LpProblem allows you to add constraints to a model by specifying them as tuples. The second element is a human-readable name for that constraint. You use the sense parameter to choose whether to perform minimization (LpMinimize or 1, which is the default) or maximization (LpMaximize or -1).

Not the answer you’re looking for? Browse other questions tagged pythonscipy or ask your own question.

Specifically, our decision variables can only be \(0\) or

\(1\), so this is known as a binary integer linear program (BILP). Such

a problem falls within the larger class of mixed integer linear programs

(MILPs), which we we can solve with milp. Constraint optimization, or constraint programming (CP), identifies feasible

solutions out of a very large set of candidates, where the problem can be

modeled in terms of arbitrary constraints. CP is based on feasibility (finding a

feasible solution) rather than optimization (finding an optimal solution) and

focuses on the constraints and variables rather than the objective function. However, CP can be used to solve optimization problems, simply by comparing the

values of the objective function for all feasible solutions.

Mixed-integer linear programming is an extension of linear programming. It handles problems in which at least one variable takes a discrete integer rather than a continuous value. Although mixed-integer problems look similar to continuous variable problems at first sight, they offer significant advantages in terms of flexibility and precision. Finally, we’ll build a simple logistic regression model to classify RADAR returns from the ionosphere. Want to learn how to build predictive models using logistic regression? This tutorial covers logistic regression in depth with theory, math, and code to help you build better models.

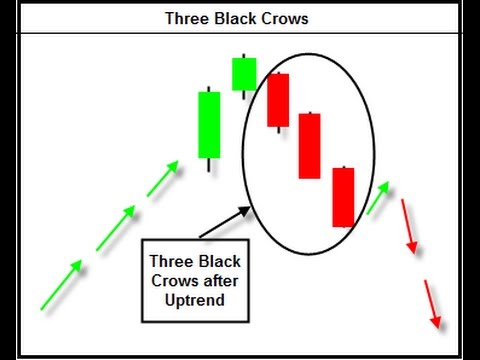

An Algo Trading Strategy which made +8,371%: A Python Case Study

Linear programming and mixed-integer linear programming are popular and widely used techniques, so you can find countless resources to help deepen your understanding. The optional parameter cat defines the category of a decision variable. If you’re working linear optimization python with continuous variables, then you can use the default value «Continuous». In this section, you’ll learn how to use the SciPy optimization and root-finding library for linear programming. Once you install it, you’ll have everything you need to start.

Step 3 – Renaming Class Labels and Visualizing Class Distribution

To take full advantage of the

Newton-CG method, a function which computes the Hessian must be

provided. The Hessian matrix itself does not need to be constructed,

only a vector which is the product of the Hessian with an arbitrary

vector needs to be available to the minimization routine. As a result,

the user can provide either a function to compute the Hessian matrix,

or a function to compute the product of the Hessian with an arbitrary

vector.

Data Science Fundamentals

Each point of the gray area satisfies all constraints and is a potential solution to the problem. This area is called the feasible region, and its points are feasible solutions. In this case, there’s an infinite number of feasible solutions. Basically, when you define and solve a model, you use Python functions or methods to call a low-level library that does the actual optimization job and returns the solution to your Python object.

This is especially the case if the function is defined on a subset of the

complex plane, and the bracketing methods cannot be used. For larger minimization problems, storing the entire Hessian matrix can

consume considerable time and memory. The Newton-CG algorithm only needs

the product of the Hessian times an arbitrary vector. If possible, using

Newton-CG with the Hessian product option is probably the fastest way to

minimize the function.