When it comes to the cost of frog cremation urns, there is a wide range of options to suit different budgets. The price of these specialized urns can vary depending on a variety of factors, including the material, design, and level of customization. Accounting costs include the financial expenditure incurred by a firm in acquiring inputs for the production of a commodity. These expenditures include salaries/wages of labour, payment for the purchase of raw materials and machinery, etc.

Business

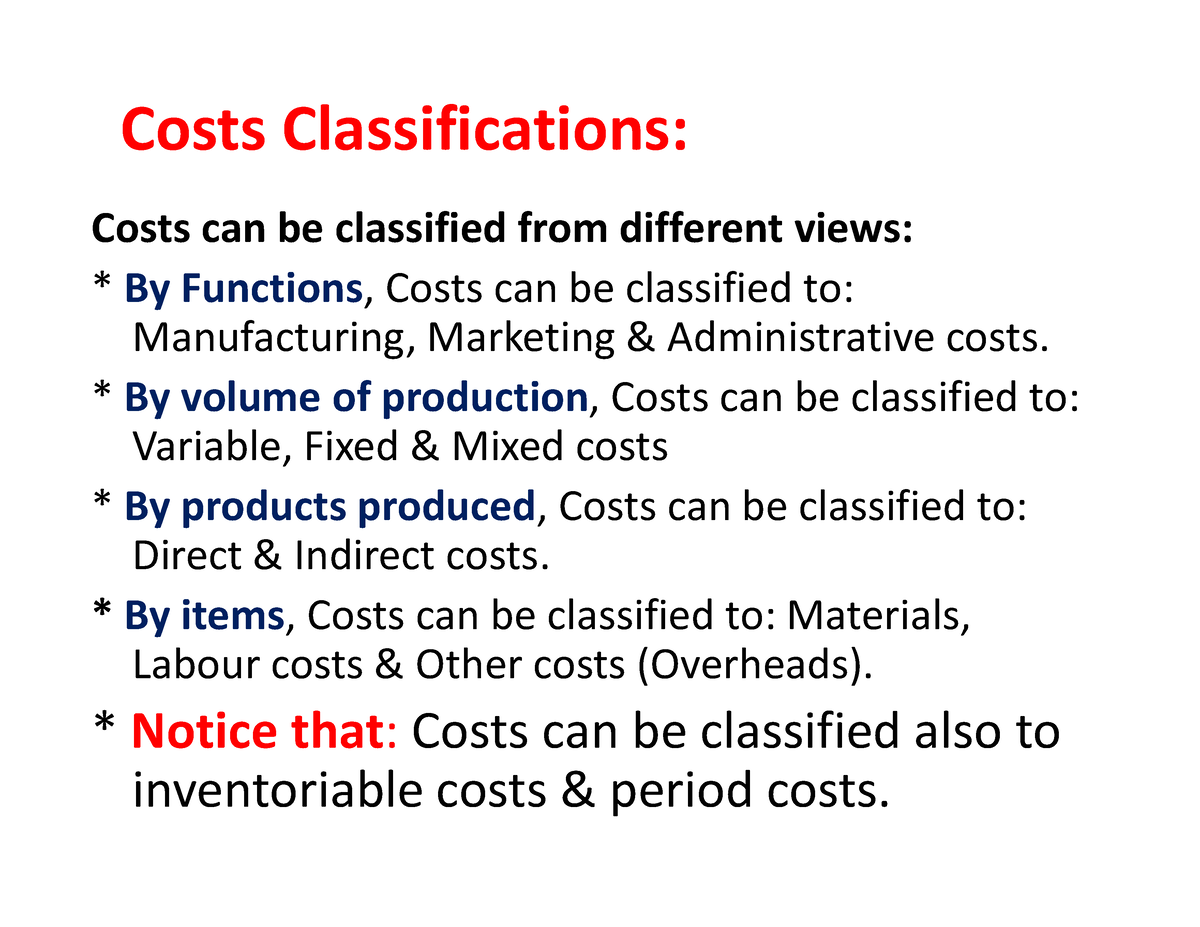

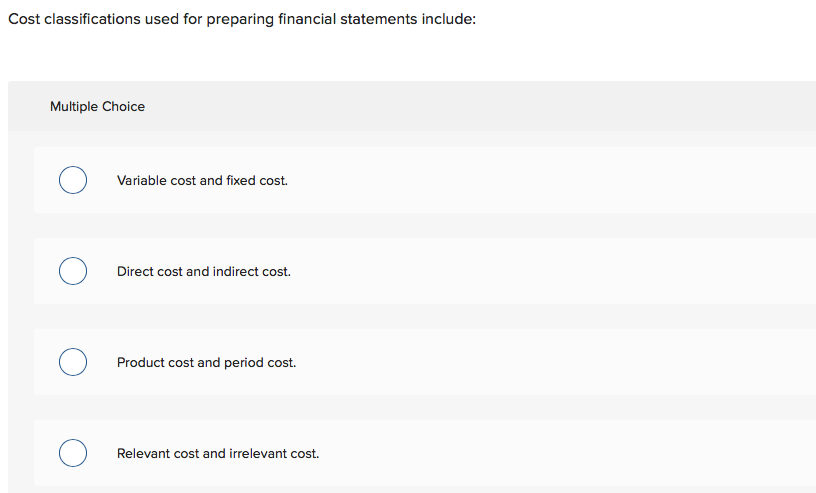

They are costs that are treated as expenses of the period in which the costs are incurred. The purpose of this article is to analyze the cost classifications and behavior patterns that are widely used in management accounting. Such an analysis will help management accountants when supplying information for planning and decision-making purposes. The cost comes to the company as it depends on the time frame the cost has occurred. The expense of today’s importance may not hold any value tomorrow, so the basic categories in this can be Historical, pre-Determined, Standard, and Estimated costs.

Sunk Costs

Historical costs simply represent a post-mortem of past events, and they are useful in ascertaining profitability but not in exercising cost control. The cost of spoilage of material over and above the normal limit is an example of an abnormal cost. Uncontrollable costs, on the other hand, are costs that cannot be influenced by the action of a specified member of an undertaking. Costs have different features or characteristics, and they are grouped or classified based on their common characteristics. The sub only cost about $100 million — roughly the cost of two F-18 Super Hornets. If a $100 million machine could sink a $6 billion machine, then the U.S. is not getting a very healthy return on its defense investment.

Cost Classification by Function

- Sunk costs are not relevant for decision making as the cost cannot be recovered at a later date.

- Factory overhead refers to all costs other than direct materials and the direct labor required to produce a product.

- Classification of cost acts as a guideline for pricing strategy and profitability analysis.

- It can also be used to set up cost-control programs, with the goal of improving net margins for the company in the future.

- Beyond the design elements, you can also customize the material of the urn itself.

Direct labor cost also includes the wages paid to those who directly carry out or operate a service, such as a driver and conductor of a bus in the transport business. These materials cannot be traced as part of the product, and their cost is distributed among the cost centers or cost units on an equitable basis. It is the cost of a contract with some terms and conditions of adjustment agreed upon between the contractee and the contractor. Contract cost usually implied to major long- term contracts as distinct from short-term job costs.

It is the value of a benefit sacrificed in favour of an alternative course of action. It is the maximum amount that could be obtained at any given point of time if a resource was sold or put to the most valuable alternative use that would be practicable. Opportunity cost of good or service is measured in terms of revenue which could have been earned by employing that good or service in some other alternative uses. These costs relating to the product are computed in advance of production, on the basis of a specification of all the factors affecting cost and cost data. Assessing the difference between the standard—most efficient—cost and the actual cost incurred is called variance analysis. If the variance analysis determines that actual costs are higher than expected, the variance is unfavorable.

In most cases, this is the sum of all direct material and direct labor costs but can sometimes include additional direct expenses. Activity-based costing (ABC) identifies overhead costs from each department and assigns them to specific cost objects, such as goods or services. ABC cost accounting is based on activities, which refer to any event, unit of work, or task with a specific goal—such as setting up machines for production, designing products, distributing finished goods, or operating machines.

These specialized urns offer a beautiful and dignified resting place for your cherished amphibian friend. Separating them allows managers to focus on controllable costs that should be monitored in order to contain or lower them. Costs may also be used to mathematically determine sales requirements to achieve desired levels of volume and profitability. Break-even analysis and other cost relationships, as well as variable costing, will address these issues. One of the primary objects of cost accounting involves analyzing the total cost of production and providing the most helpful information.

To ensure that you understand how and why product costing is done in manufacturing companies, we use many manufacturing company examples. However, since many of you could have careers in service or merchandising companies, we also use non-manufacturing examples. The term “cost accounting” is sometimes used interchangeably with the term “managerial accounting,” but cost accounting is actually a subset of managerial accounting.

For example, in a petroleum refinery industry, petrol, diesel oil, kerosene oil, naptha, tar etc. are produced jointly in the refinery process. It is the aggregate cost related to a cost unit which consists of a group of similar articles which maintain its identity throughout one or more stages of production. For example excessive scrap may arise from inadequate supervision how to prevent a tax hit when selling a rental property or from latent defect in purchased material. The controllable cost is a cost that can be influenced and regulated during a given time span by the actions of a particular individual within an organization. The controllable cost is a cost chargeable to a budget or cost centre, which can be influenced by the actions of the person in whom control of the centre is vested.